PMFBY (Pradhan Mantri Fasal Bima Yojana) is a government crop insurance scheme that provides financial help to farmers if their crops are damaged by natural disasters, pests, or diseases. Farmers pay a small premium, and the government covers the rest. It aims to protect farmers’ income and encourage better farming practices.

| Key Highlight | Details |

|---|---|

| Name of the Scheme | Pradhan Mantri Fasal Bima Yojana |

| Launched By | Government of India |

| Launch Date | 1st January 2025 |

| Announced By | Prime Minister of India |

| Purpose | Provide crop insurance |

| Beneficiaries | Farmers |

| Target Beneficiaries | Farmers |

| Advantage | Provide crop insurance |

| Eligibility Criteria | Permanent resident of India, Farmer |

| Required Documents | Aadhaar Card, Application process details |

| Application Process | Online |

| Financial Commitment | ₹ 69,515.71 crore |

| Expected Benefits | Minimizing loss |

Pradhan Mantri Fasal Bima Yojana (PMFBY) continues its vital work for our farmers with a significant budget of ₹69,515.71 crore allocated by the central government in 2025! This continued commitment, announced on January 1st, 2025, by the Union Cabinet, underscores the government’s dedication to providing a safety net for our agricultural community against the unpredictable forces of nature.

💡Land records for other states are on the E-district portal, UP Bhulekh, MP Land Record, Hamraazweb, Jharbhoomi and Mee-Bhoomi Online Portal. Also, check the PM Kisan 20th installment status and PM Vishwakarma Yojana.

How to Enroll in PMFBY

Visit the official PMFBY website: https://pmfby.gov.in/. and click on the “Farmer Corner“, then a new pop-up screen, now click on the “Sign Up” button to register as a new farmer user.

Register as a New Farmer User

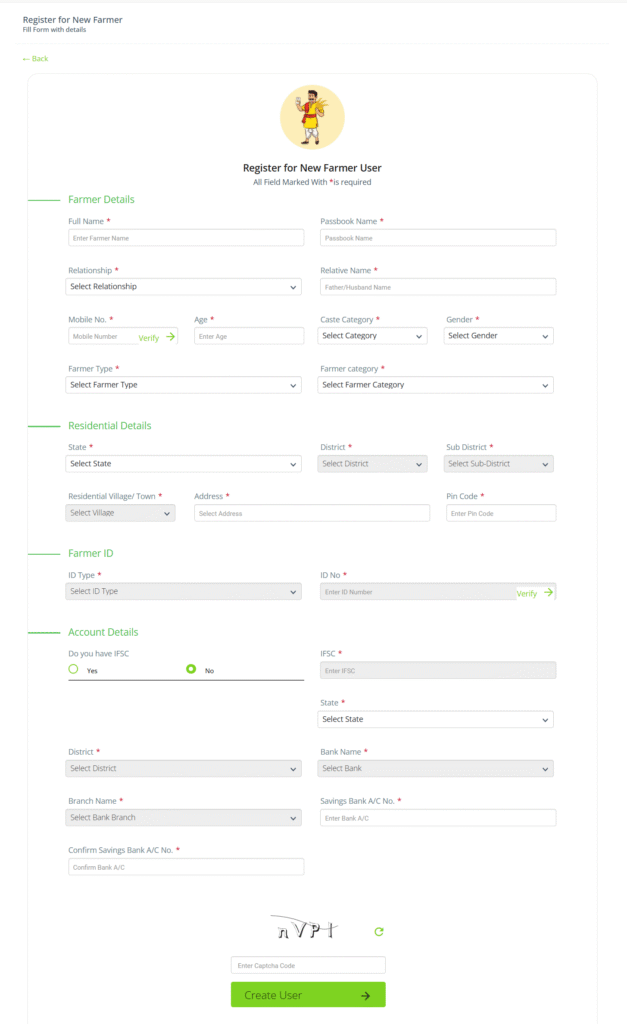

This form requires you to fill in details across several sections. All fields marked with an asterisk (*) are mandatory.

1. Farmer Details

- Full Name*: Enter your complete full name as it appears on your official documents.

- Passbook Name*: Enter the name as it appears on your bank passbook. This is important for account verification.

- Relationship*: Select your relationship with the Relative Name you will provide in the next step (S/O – Son of, D/O – Daughter of, W/O – Wife of, C/O – Care of).

- Relative Name*: Enter the full name of your father, mother, husband, or other relevant guardian based on the relationship you selected.

- Mobile No.*: Enter your active mobile phone number. You might receive a verification OTP on this number. Click on the “Verify” button after entering your mobile number to proceed with verification (if applicable).

- Age*: Enter your current age in years.

- Caste Category*: Select your caste category from the dropdown menu (GENERAL, OBC, SC, ST).

- Gender*: Select your gender from the options (Male, Female, Other).

- Farmer Type*: Select the type of farmer you are from the dropdown menu (Small, Marginal, Others). The definitions of these categories might vary based on government guidelines.

- Farmer category*: Select your category as a farmer (Owner, Tenant, Sharecropper).

2. Residential Details

- State*: Select your current residential state from the extensive dropdown list.

- District*: Once you select your state, a new dropdown will appear. Select your residential district.

- Sub District*: After selecting the district, another dropdown will appear. Choose your residential sub-district (also known as Taluka or Tehsil).

- Residential Village/ Town*: Select your residential village or town from the provided dropdown list.

- Address*: Enter your complete residential address.

- Pin Code*: Enter the 6-digit pin code of your residential area.

3. Farmer ID

- ID Type*: Select the type of identification you will use from the dropdown menu. The example shows “UID” (likely Aadhaar Card) as an option. Other options might be available.

- ID No*: Enter the identification number corresponding to the ID type you selected.

- Verifyarrow_forward: Click this button after entering your ID number to verify it (if applicable).

4. Account Details

- Do you have an IFSC? – Select either “Yes” or “No“.

- If you select “Yes”:

- IFSC*: Enter the 11-character Indian Financial System Code of your bank branch.

- State*: Select the state where your bank branch is located.

- District*: Select the district where your bank branch is located.

- Bank Name*: Select the name of your bank from the dropdown list.

- Branch Name*: Select the specific branch name of your bank from the dropdown list.

- Savings Bank A/C No.*: Enter your savings bank account number.

- Confirm Savings Bank A/C No.*: Re-enter your savings bank account number to ensure accuracy.

- If you select “No”: You will likely be prompted to provide the State, District, Bank Name, and Branch Name so the system can help you find the IFSC code. Then you will proceed to enter your account number and confirm it.

- If you select “Yes”:

5. Final Steps

- Create User: Once you have filled in all the required fields accurately, click on the “Create User” button to submit your registration for the New FarmerFill Form.

- Don’t Refresh Page: This button likely refreshes the form, clearing any entered data. Avoid clicking this unless you want to start over.

💡Remember to double-check all the information you have entered before submitting the form. Providing incorrect information may lead to issues with your registration.

After clicking “Create User,” you might receive a confirmation message on the screen or via the mobile number you provided. Make sure to keep a record of any registration ID or reference number you receive.

Offline Application Process

STEP 1: Go to your nearest participating bank branch, an authorized Common Service Center (CSC), the local office of an insurance company under PMFBY, or the District Agriculture Office (DAO).

STEP 2: Ask for the PMFBY application form.

STEP 3: Fill the Form and complete all the details accurately.

STEP 4: Submit the form with photocopies of your land records (Khasra number or account number), proof of sowing, Aadhaar card, and bank details. You’ll also need to pay your share of the premium.

STEP 5: Get Acknowledgement and make sure to get a receipt for your application.

Already Applied? Here’s How to Check Your PMFBY Status (2025) – Good news for those who have already applied! The government has made it easy to track your application status online. This saves both your time and effort, as well as the government’s resources.

How to Check Your PMFBY Application Status

STEP 1: Go to the Official PMFBY Website @ pmfby.gov.in.

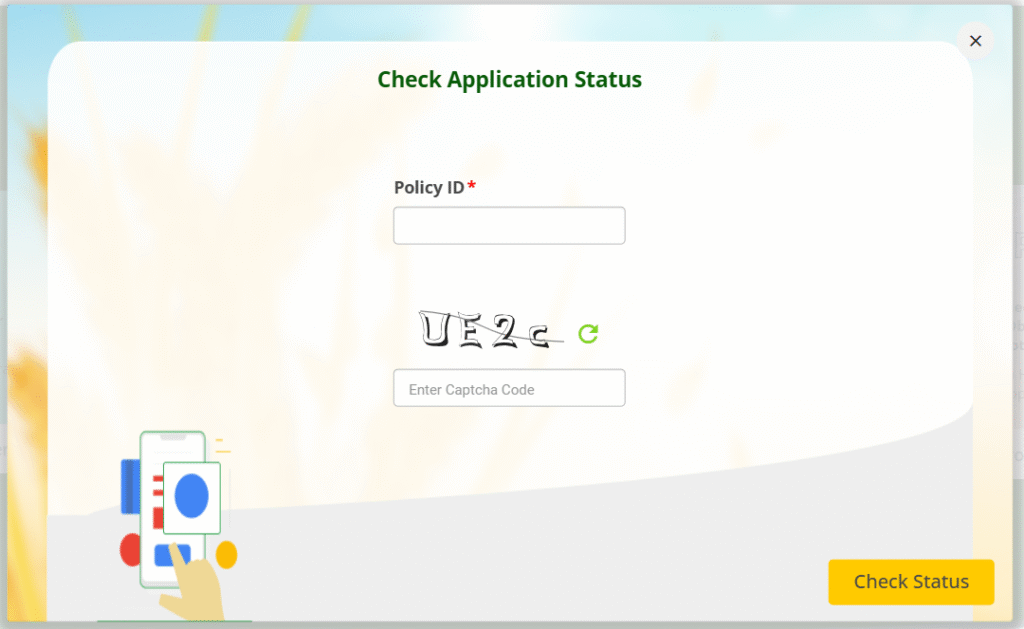

STEP 2: On the homepage, find and click on the “Application Status” option.

STEP 3: A new page will appear where you need to enter the Receipt Number or Policy ID that was provided to you during the application process. You will also need to enter the captcha code shown on the screen for security verification.

STEP 4: After entering the details, double-check them and click the “check status” button. Your current application status will be displayed.

Why is Online Status Check Helpful?

- Convenience: Farmers can check their application status from their homes.

- Time and Effort Saving: No need to visit government offices or banks to inquire about the status.

- Transparency: Provides a transparent way for farmers to track the progress of their application.

Need Help? Here’s the Contact Information – For any queries or assistance regarding the PM Fasal Bima Yojana, you can contact the toll-free number: 14447.

Required Documents

To enroll in the PMFBY, make sure you have the following documents ready:

- Aadhaar card (This is a primary identification document).

- PAN card (Permanent Account Number).

- Ration card (Proof of address and household).

- Land records (Documents proving ownership or tenancy of the agricultural land).

Key Features

- Significant Budget: The substantial allocation of ₹69,515.71 crore demonstrates the government’s strong financial backing for the scheme.

- Comprehensive Risk Coverage: The scheme safeguards farmers against losses arising from a wide range of non-preventable natural calamities.

- Proven Track Record: Over the past eight years, the central government has already provided substantial insurance benefits, reaching up to ₹1.7 crore for our farmers, highlighting the scheme’s effectiveness.

PMFBY PREMIUM RATES AND SUBSIDY

The premium rates for farmers under the Pradhan Mantri Fasal Bima Yojana (PMFBY) are capped at the following percentages of the Sum Insured:

| Season | Crops | Maximum Premium Rate Payable by Farmer (% of Sum Insured) |

|---|---|---|

| Kharif | All Foodgrain and Oilseeds crops (all Cereals, Millets, Pulses, and Oilseeds crops) | 2.0% or Actuarial Rate, whichever is less |

| Rabi | All Foodgrain and Oilseeds crops (all Cereals, Millets, Pulses, and Oilseeds crops) | 1.5% or Actuarial Rate, whichever is less |

| Kharif & Rabi | Annual Commercial / Annual Horticultural crops | 5% or the Actuarial Rate, whichever is less |

Who Can Benefit? (Eligibility)

To be eligible for the PM Fasal Bima Yojana, you need to meet a few straightforward criteria:

- Resident of India: You must be a permanent resident of India.

- Farmer by Profession: Your primary occupation should be farming.

- Impacted by Natural Calamities: Your crops must have suffered damage due to non-preventable natural disasters.

What Advantages Does PMFBY Offer?

This scheme brings several significant benefits to our farming community:

- Affordable Crop Insurance: You can access crucial crop insurance at a very minimal premium.

- Protection Against Losses: You can rest assured that you won’t face complete financial ruin if your crops are damaged by natural calamities.

- Low Premium, Wide Coverage: The low premium rates make the scheme accessible to even small and marginal farmers.

- Encouraging Modern Farming: By reducing financial risks, the scheme encourages farmers to adopt modern agricultural techniques and technologies, potentially leading to better yields and income.

Contact Details

| PMFBY Whatsapp Chatbot | 7065514447 |

| Krishi Rakshak Portal helpline | 14447 |